Duty free allowances

New Zealand

As an international traveller you are entitled to bring a certain amount/value of goods that are free of Customs duty and exempt Goods and Services tax (GST) into New Zealand. This is called your duty free allowance and personal goods concession. See below to find out more or click here for full customs information.

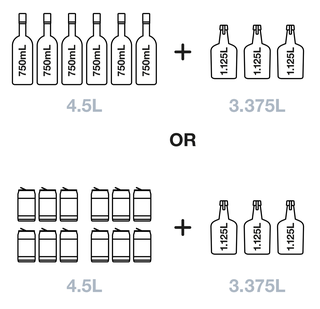

Alcohol

Your duty free allowance entitles you to bring into New Zealand the following quantities of alcohol products free of customs duty and GST provided you are over 17 years of age. Please be aware you do need to be 18 years of age or over to buy alcohol in New Zealand.

-

Up to six bottles (4.5 litres) of wine, champagne, port or sherry.

-

Or up to twelve cans (4.5 litres) of beer.

-

And three bottles (or other containers) each containing not more than 1125ml of spirits, liqueur, or other spirituous beverages.

Customs also require that the goods:

- accompany you through the Customs arrival process;

- are for your own personal use, or intended as gifts;

- are not carried on behalf of another person; and

- are not intended for sale or exchange.

Quantities of alcohol imported in excess of the allowances, or housed in containers greater than the maximum stipulated bottle size, are liable for Customs charges.

Personal goods concession

All items other than alcohol and tobacco, have an allowance of NZ$700 even if purchased for personal use as part of your personal goods concession. Please note:

- If the value of your goods is over NZ$700 then they may attract customs duty and GST.

- Customs charges may also be payable on gifts exceeding NZ$110 in value.

- If you're travelling with other people, you cannot combine your $700 concessions.

Personal effects

If you live in New Zealand and have bought items whilst travelling you will not be required to pay duties on arrival into New Zealand if:

-

they are strictly personal clothing, toiletries and personal jewellery (including watches);

-

they are for your own use and wear; and

-

they are not for gifting or selling.

Other countries

Before you purchase it's a good idea to check your duty free allowance for arrival into your travel destination and be aware of the liquids, aerosols and gels (LAGs) security restrictions when you are transiting through other international airports. Otherwise your purchase may be confiscated if you exceed the overseas quantity or value limits.

Alcohol

There are legal limits on the amount of duty free alcohol and other goods travellers can take into other international destinations. These amounts will vary depending on the country you are flying into. The following table can be used as a guide, but we always recommend you check the latest limits and exemptions under each country's customs requirements.

| Country / Territory | Alcohol |

|---|---|

| Australia | 2.25 litres of alcohol |

| Canada | 1 litre of alcohol |

| China | 1.5 litres of alcohol |

| Fiji | 2.25 litres spirits or liqueur or 4.5 litres wine or beer |

| Hong Kong SAR | 1 litre of alcohol |

| India | 2 litre of spririts or wine |

| Japan | 3 x 750ml of alcohol |

| Malaysia | 1 litre of alcohol |

| New Caledonia | 2 litres of spirits (except Aniseed or Absinthe) and 2 litres of wine |

| New Zealand | Up to 3 litres of spirits or liqueur (conditions apply) and six bottles of wine, port or sherry |

| Norfolk Island | 1 litre of alcohol |

| Samoa | 2.25 litres of alcohol |

| Singapore | 1 litre of spirits and 1 litre wine or beer |

| South Africa | 1 litre spirits and 2 litres wine |

| Thailand | 1 litre of alcohol |

| Tonga | 2.25 litres of spirits and 4.5 litres of wine |

| United Kingdom | 1 litre of spririts and 2 litres of wine |

| United States of America | 1 litre of alcohol |

Liquids, aerosols and gels (LAGs)

Due to airline safety regulations, there are certain restrictions on the amount of liquids, aerosols and gels (LAGs) you can carry onboard the plane. When you collect your order from The Mall, you will already have passed through Auckland Airport security, meaning that you’ll be able to board without this restriction. All items sold on The Mall are safe to travel with in your carry-on luggage and will be packed in clear sealed bags for your arrival into your next destination.

If your journey includes a stopover or transit at another airport, other restrictions may apply.

Here are some helpful tips:

If you are travelling on a flight with no stopovers to your final destination (e.g Auckland – Australia) then you will be able to carry items into your destination. We recommend you check your duty free allowance limits for arrival into that country and cabin baggage allocations for your airline.

If you are travelling on flights with multiple stops and where you leave the airport at your next destination (e.g. Auckland – Singapore – London) then yes, you can buy duty free and other 'liquids' to take with you so long as you:

- have access to your checked-in luggage at your next destination

- pack your items at your next destination into your check-in luggage before continuing your journey

We recommend you check your duty free allowance limit for arrival into that country and cabin baggage allocations for your airline.

If you are transiting at another airport to then travel on to your final destination you will be security screened. Any items over 100ml will likely be confiscated at the screening point in compliance with the LAGs security restrictions.

If you are going on a return trip to New Zealand and would like to purchase items that are over 100mls, we recommend that you purchase to pick up on your arrival into Auckland.

Rules for travelling with food

Taking food on your travels in and out of New Zealand, whether for your personal use or as a gift, might be subject to certain restrictions that you need to familiarise yourself with prior to your overseas trip. These will differ depending on the type of food, packaging and/or a destination country.

Please read carefully the rules established by the NZ Ministry for Primary Industries for taking food overseas and bringing food into New Zealand.

Please be advised that compliance to these rules is compulsory to prevent potential disappointment with confiscation. We, The Mall, will not be legally obliged to issue a refund or exchange for a food item purchased that does not comply to these provisions.